Extended version of 2CLICK — built for the way hospitality operations work

Automation built for hotels and hospitality

2CLICK for Hospitality streamlines financial workflows across your entire operation — from PMS folios and PSP settlements to ERP-ready outputs.

Simple PMS Integration 🧩

Automate your PMS with 2CLICK

Streamline your accounting with daily PMS synchronization, reduced manual work and a seamless connection to your ERP system.

2CLICK for Hospitality

Smart PMS Transaction Handling — Fully Automated, Always Accurate

2CLICK collects folios and postings from your PMS — including Opera, ONQ, and Apaleo — and aligns them with your PSP payment activity. The system validates, enriches, and maps each transaction, turning raw operational data into clear, finance-ready outputs that flow directly into your ERP.

Daily automated synchronization

Every charge, posting, adjustment, and settlement in your PMS is captured and structured automatically. 2CLICK standardizes revenue, corrects inconsistencies, and applies a consistent financial logic across all properties — helping ensure PMS data becomes reliable accounting data.

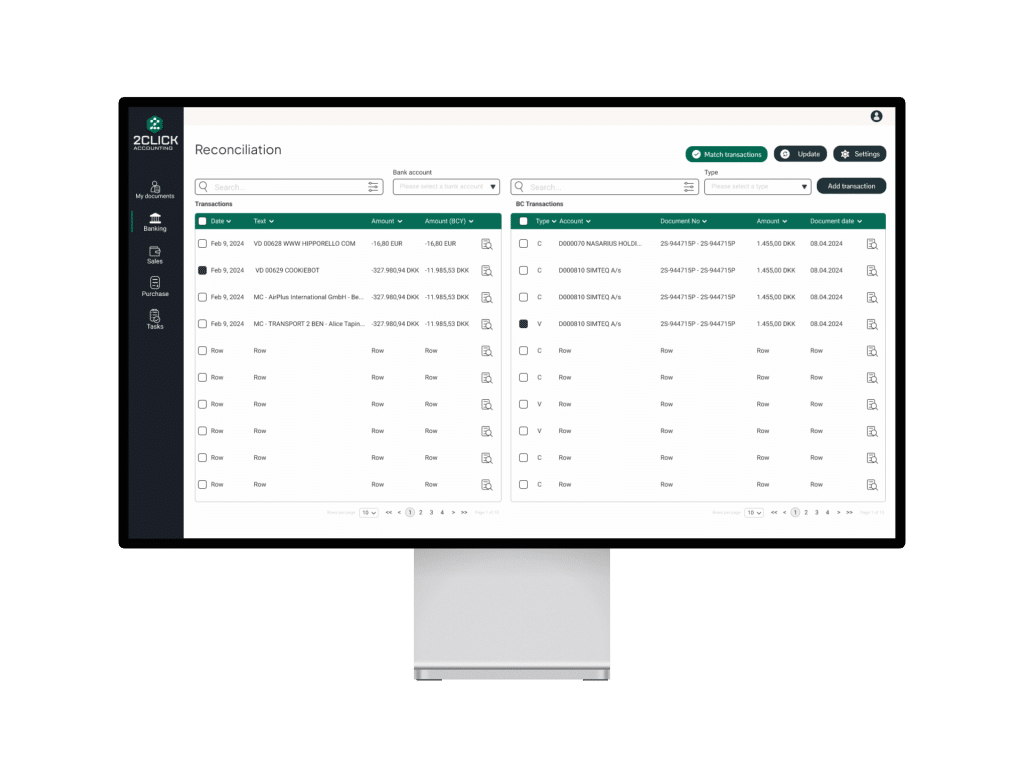

PSP Payment Matching

2CLICK consolidates all payment transactions — authorizations, captures, refunds, and fees — and aligns them with PMS folio payments using intelligent matching rules.

Say goodbye to missing payouts, mismatched deposits, or unexplained differences.

Automated Journal Creation

2CLICK applies your chart of accounts, tax rules, and business mappings to generate structured financial data ready for ERP posting.

Your finance team gets day-to-day clarity, full traceability, and a clean audit trail across all hotel operations.

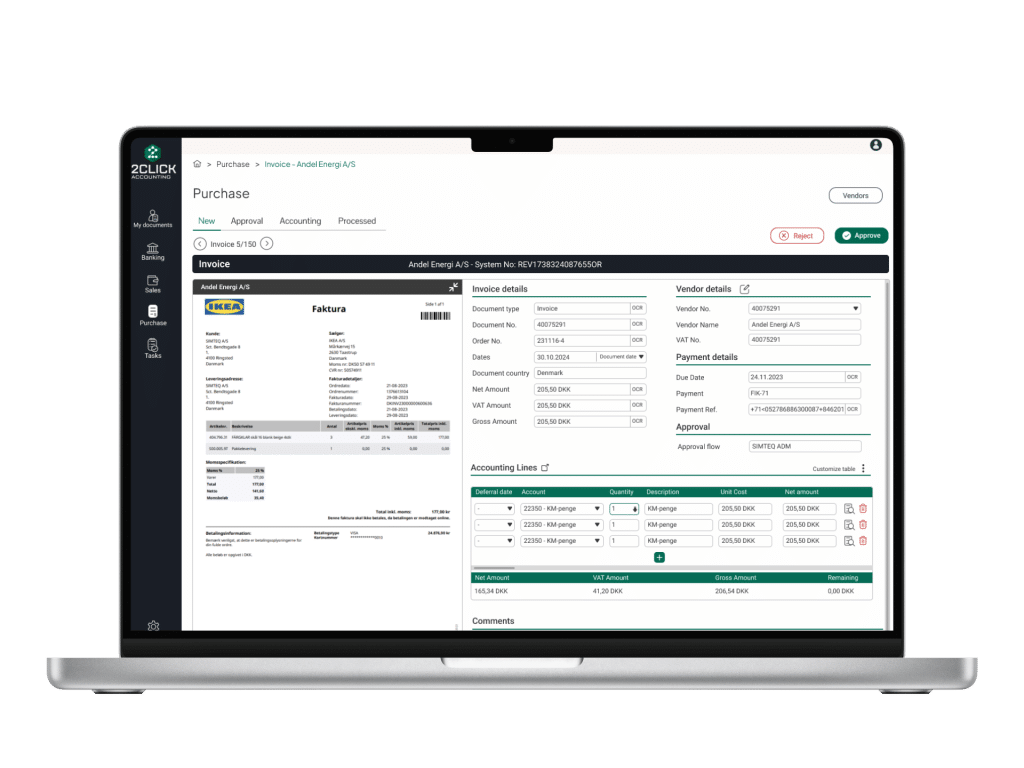

Purchase Order Matching

Automated Purchase Order Matching — Accurate, Efficient, Fully Controlled

2CLICK enhances your ERP by automating the entire invoice matching process — from PO line comparison to tolerance checks and difference handling.

Whether you use straightforward 2-way validation or more advanced 3-way matching, the engine helps ensure consistent, reliable results with far less manual effort.

Flexible 2-Way and 3-Way Matching

Match invoices against purchase orders and receipts using configurable logic that fits how your organization works.

Enable or skip 3-way matching, apply automated line-level validation, and ensure each invoice is processed according to your defined rules.

Smart Tolerance & Difference Handling

Set percentage- or amount-based tolerances, allow minor variances automatically, and control exactly how differences should be posted.

2CLICK provides consistent handling of discrepancies, reduces manual adjustments, and prevents approval delays.

Auto-Posting and Controlled Adjustments

Automate posting when invoices match your criteria, or let 2CLICK insert difference lines within the defined tolerances. You maintain complete visibility and control, while repetitive work is minimized — enabling faster, smoother invoice processing.

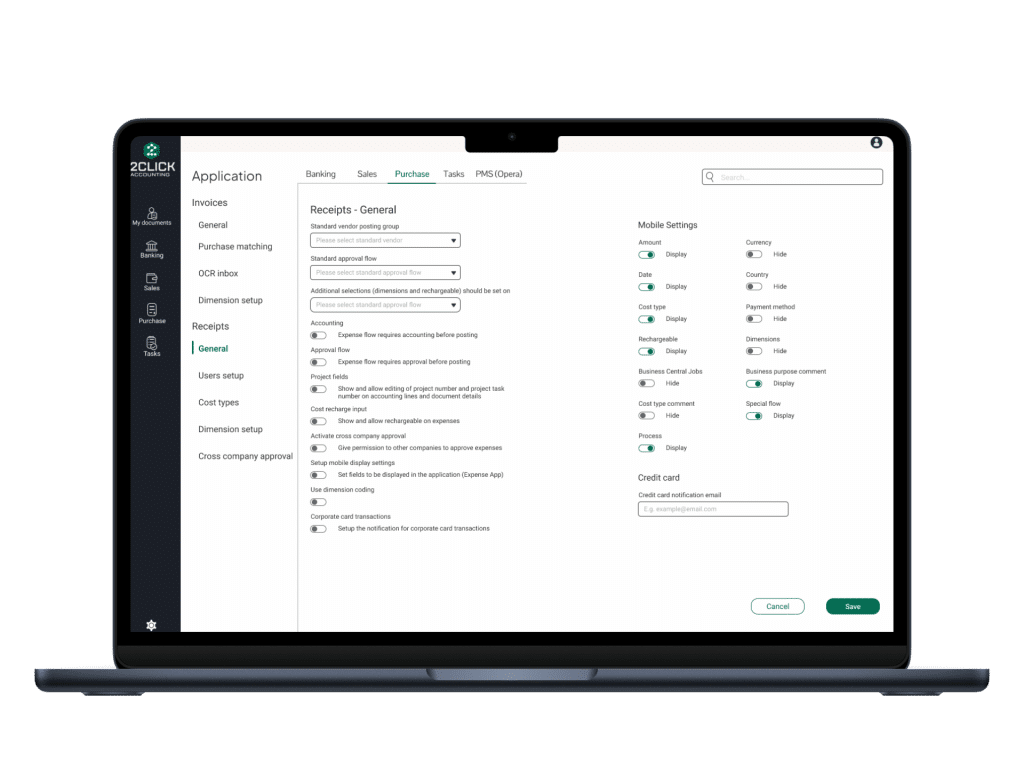

Cross-Company Approvals

Cross-Company Invoice Approvals — Clear Rules, Full Control, Zero Friction

In hotel groups and hospitality operations, invoices and expenses often require approval from a different legal entity than the one that receives the invoice. 2CLICK supports structured cross-company approval flows, routing invoices to the correct entity based on your posting rules — without manual forwarding, emails, or inconsistent handling.

Built for Multi-Entity Hospitality

Hotels frequently share departments, services, or centralized finance teams.

2CLICK ensures every invoice is routed to the right entity for review and posting — whether it belongs to a specific property, a shared service department, or head office finance.

Rule-Based Cross-Company Logic

Define your rules once, and 2CLICK applies them consistently.

Every invoice follows the same structured, predictable path, reducing uncertainty and removing manual decision-making.

Compliance, Control and Simpler Audit Trails

Cross-company approvals create clear responsibility and clean financial records.

2CLICK logs who approved the invoice, in which entity, and under which rule — providing transparency and a straightforward audit trail for controllers, auditors, and group finance teams.

Integrated Apps

All your apps,

connected in one platform

We help your business stay connected with ERP, Bank, and PMS integrations — so automation fits naturally into your workflows.

What does our customers say?

Trusted by teams who value automation and efficiency

Get your answers

Frequently Asked Questions about 2CLICK Hospitality

Contact Us

Get in touch

Get in touch today – we’d love to answer your questions.